Sales Tax Form Quarterly . If you do not file electronically, please use the preprinted forms we mail to our taxpayers. texas sales and use tax forms. 12 rows find quarterly sales tax filer forms and instructions. In accordance with changes signed into law in june of 2022, a larger business registrant will be required. Each sale, admission, storage, or rental in florida is taxable, unless the transaction is exempt. texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable. sales & excise forms. have this form available when you file your short form electronically using webfile. effective july 30, 2021, all businesses reporting sales or use tax from 3 or more locations, are required to file sales and use tax return(s) electronically.

from www.formsbank.com

texas sales and use tax forms. texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable. 12 rows find quarterly sales tax filer forms and instructions. Each sale, admission, storage, or rental in florida is taxable, unless the transaction is exempt. sales & excise forms. have this form available when you file your short form electronically using webfile. If you do not file electronically, please use the preprinted forms we mail to our taxpayers. effective july 30, 2021, all businesses reporting sales or use tax from 3 or more locations, are required to file sales and use tax return(s) electronically. In accordance with changes signed into law in june of 2022, a larger business registrant will be required.

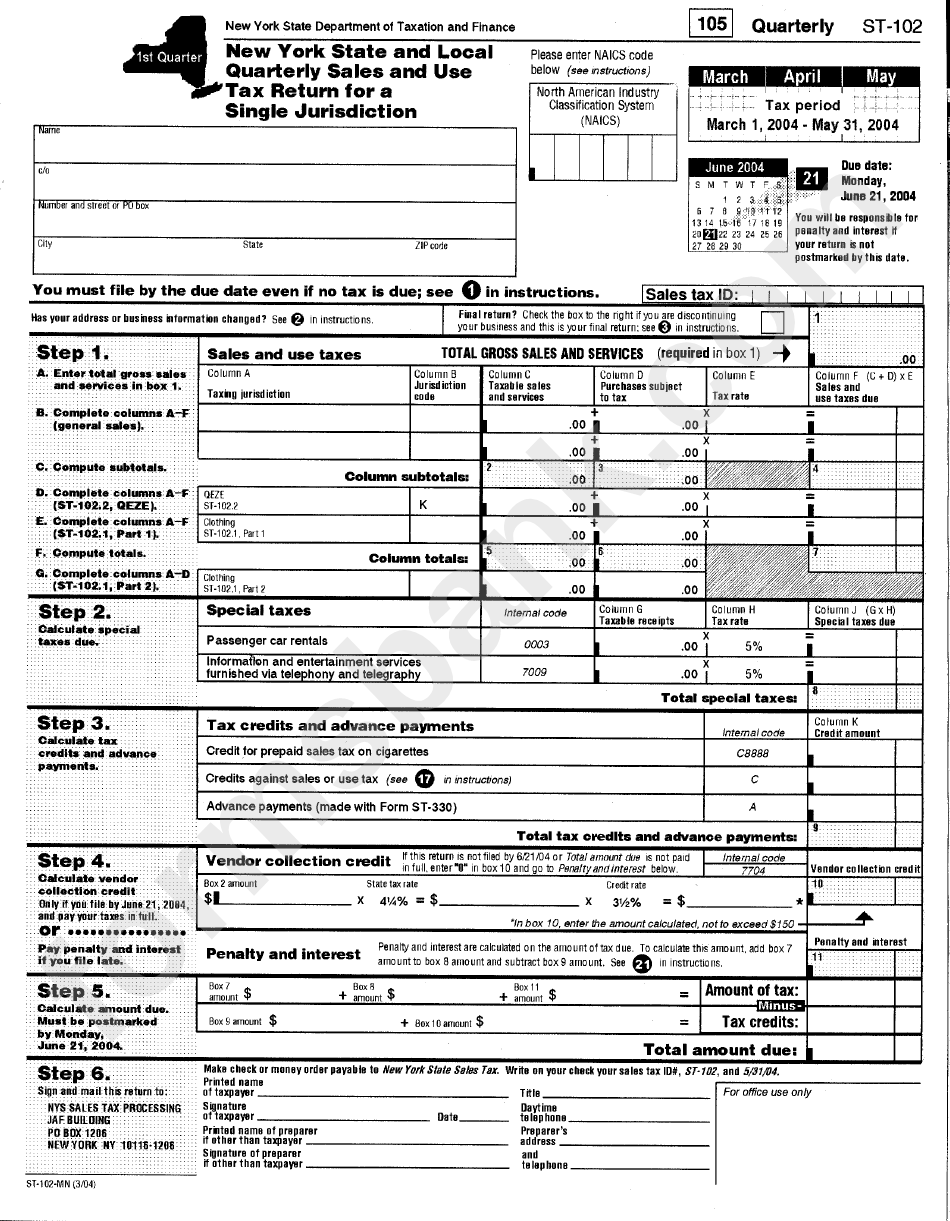

Form St102 New York State And Local Quarterly Sales And Use Tax Return For A Single

Sales Tax Form Quarterly If you do not file electronically, please use the preprinted forms we mail to our taxpayers. If you do not file electronically, please use the preprinted forms we mail to our taxpayers. sales & excise forms. texas sales and use tax forms. effective july 30, 2021, all businesses reporting sales or use tax from 3 or more locations, are required to file sales and use tax return(s) electronically. Each sale, admission, storage, or rental in florida is taxable, unless the transaction is exempt. have this form available when you file your short form electronically using webfile. texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable. In accordance with changes signed into law in june of 2022, a larger business registrant will be required. 12 rows find quarterly sales tax filer forms and instructions.

From www.templateroller.com

Form 5080 Download Fillable PDF or Fill Online Sales, Use and Withholding Taxes Monthly Sales Tax Form Quarterly In accordance with changes signed into law in june of 2022, a larger business registrant will be required. effective july 30, 2021, all businesses reporting sales or use tax from 3 or more locations, are required to file sales and use tax return(s) electronically. texas imposes a 6.25 percent state sales and use tax on all retail sales,. Sales Tax Form Quarterly.

From www.formsbank.com

Quarterly Return Form Business And Occupational Privilege (Gross Sales) Tax printable pdf download Sales Tax Form Quarterly If you do not file electronically, please use the preprinted forms we mail to our taxpayers. sales & excise forms. 12 rows find quarterly sales tax filer forms and instructions. texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable. texas sales. Sales Tax Form Quarterly.

From www.pdffiller.com

5080 Form 2022 Fill Online, Printable, Fillable, Blank pdfFiller Sales Tax Form Quarterly Each sale, admission, storage, or rental in florida is taxable, unless the transaction is exempt. 12 rows find quarterly sales tax filer forms and instructions. In accordance with changes signed into law in june of 2022, a larger business registrant will be required. texas imposes a 6.25 percent state sales and use tax on all retail sales, leases. Sales Tax Form Quarterly.

From www.formsbank.com

Quarterly Return Business & Occupation Privilege(Gross Sales) Tax City Of Ravenswood, West Sales Tax Form Quarterly If you do not file electronically, please use the preprinted forms we mail to our taxpayers. texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable. In accordance with changes signed into law in june of 2022, a larger business registrant will be required. . Sales Tax Form Quarterly.

From mpm.ph

Complete Guide to Quarterly Percentage Tax (BIR Form 2551Q) Sales Tax Form Quarterly texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable. If you do not file electronically, please use the preprinted forms we mail to our taxpayers. 12 rows find quarterly sales tax filer forms and instructions. Each sale, admission, storage, or rental in florida. Sales Tax Form Quarterly.

From www.formsbank.com

Business And Occupation Privilege Form (Gross Sales) Tax Quarterly (Estimate) Return State Sales Tax Form Quarterly In accordance with changes signed into law in june of 2022, a larger business registrant will be required. effective july 30, 2021, all businesses reporting sales or use tax from 3 or more locations, are required to file sales and use tax return(s) electronically. texas sales and use tax forms. Each sale, admission, storage, or rental in florida. Sales Tax Form Quarterly.

From www.formsbank.com

Form St102Mn Quarterly Sales And Use Tax Return For Single Jurisdiction printable pdf download Sales Tax Form Quarterly effective july 30, 2021, all businesses reporting sales or use tax from 3 or more locations, are required to file sales and use tax return(s) electronically. 12 rows find quarterly sales tax filer forms and instructions. Each sale, admission, storage, or rental in florida is taxable, unless the transaction is exempt. In accordance with changes signed into law. Sales Tax Form Quarterly.

From www.formsbank.com

Sales And Use Tax Return Quarterly Form printable pdf download Sales Tax Form Quarterly have this form available when you file your short form electronically using webfile. 12 rows find quarterly sales tax filer forms and instructions. In accordance with changes signed into law in june of 2022, a larger business registrant will be required. texas sales and use tax forms. If you do not file electronically, please use the preprinted. Sales Tax Form Quarterly.

From www.signnow.com

St810 20202024 Form Fill Out and Sign Printable PDF Template airSlate SignNow Sales Tax Form Quarterly sales & excise forms. 12 rows find quarterly sales tax filer forms and instructions. effective july 30, 2021, all businesses reporting sales or use tax from 3 or more locations, are required to file sales and use tax return(s) electronically. In accordance with changes signed into law in june of 2022, a larger business registrant will be. Sales Tax Form Quarterly.

From www.templateroller.com

Form 5095 2023 Fill Out, Sign Online and Download Fillable PDF, Michigan Templateroller Sales Tax Form Quarterly If you do not file electronically, please use the preprinted forms we mail to our taxpayers. texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable. effective july 30, 2021, all businesses reporting sales or use tax from 3 or more locations, are required. Sales Tax Form Quarterly.

From www.formsbank.com

Quarterly Sales Tax Return Instructions And Worksheet Iowa Department Of Revenue And Finance Sales Tax Form Quarterly 12 rows find quarterly sales tax filer forms and instructions. sales & excise forms. have this form available when you file your short form electronically using webfile. If you do not file electronically, please use the preprinted forms we mail to our taxpayers. effective july 30, 2021, all businesses reporting sales or use tax from 3. Sales Tax Form Quarterly.

From www.formsbank.com

Quarterly Return Business And Occupation Privilege (Gross Sales) Tax Form printable pdf download Sales Tax Form Quarterly Each sale, admission, storage, or rental in florida is taxable, unless the transaction is exempt. texas sales and use tax forms. In accordance with changes signed into law in june of 2022, a larger business registrant will be required. texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most. Sales Tax Form Quarterly.

From www.formsbank.com

Form St100 New York State And Local Quarterly Sales And Use Tax Return printable pdf download Sales Tax Form Quarterly texas sales and use tax forms. In accordance with changes signed into law in june of 2022, a larger business registrant will be required. Each sale, admission, storage, or rental in florida is taxable, unless the transaction is exempt. If you do not file electronically, please use the preprinted forms we mail to our taxpayers. effective july 30,. Sales Tax Form Quarterly.

From www.sampleforms.com

FREE 9+ Sample Federal Tax Forms in PDF MS Word Sales Tax Form Quarterly effective july 30, 2021, all businesses reporting sales or use tax from 3 or more locations, are required to file sales and use tax return(s) electronically. have this form available when you file your short form electronically using webfile. In accordance with changes signed into law in june of 2022, a larger business registrant will be required. . Sales Tax Form Quarterly.

From www.dochub.com

Boe sales tax form Fill out & sign online DocHub Sales Tax Form Quarterly texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable. effective july 30, 2021, all businesses reporting sales or use tax from 3 or more locations, are required to file sales and use tax return(s) electronically. have this form available when you file. Sales Tax Form Quarterly.

From lorrainewlexie.pages.dev

Quarterly Sales Tax Due Dates 2024 Magdaia Sales Tax Form Quarterly texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable. In accordance with changes signed into law in june of 2022, a larger business registrant will be required. texas sales and use tax forms. sales & excise forms. effective july 30, 2021,. Sales Tax Form Quarterly.

From www.dochub.com

Sales tax refund texas Fill out & sign online DocHub Sales Tax Form Quarterly In accordance with changes signed into law in june of 2022, a larger business registrant will be required. texas sales and use tax forms. Each sale, admission, storage, or rental in florida is taxable, unless the transaction is exempt. sales & excise forms. effective july 30, 2021, all businesses reporting sales or use tax from 3 or. Sales Tax Form Quarterly.

From www.formsbank.com

Quarterly Return Form Business And Occupational Privilege (Gross Sales) Tax printable pdf download Sales Tax Form Quarterly sales & excise forms. Each sale, admission, storage, or rental in florida is taxable, unless the transaction is exempt. texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable. If you do not file electronically, please use the preprinted forms we mail to our. Sales Tax Form Quarterly.